In my recent conversations with 100+ SaaS companies, there has been one surprising statistic: 75% are behind on their revenue goals or at significant risk not meeting their targets in the upcoming two quarters. 75%! I needed to digest that.

The implications:

Stressed leadership with fear of loosing their jobs

Nervous investors asking much deeper into each dollar spent

Cost-cutting exercises across the board without considering the 2nd order consequences on midterm revenue growth

Not a positive environment to be in.

When diving into the underlying reasons there are some overarching themes:

Yes, recession and challenging market conditions are one of them. But another common one seems to be a significant gap between revenue planning and execution. So let’s unpack that step by step.

What is a revenue plan?

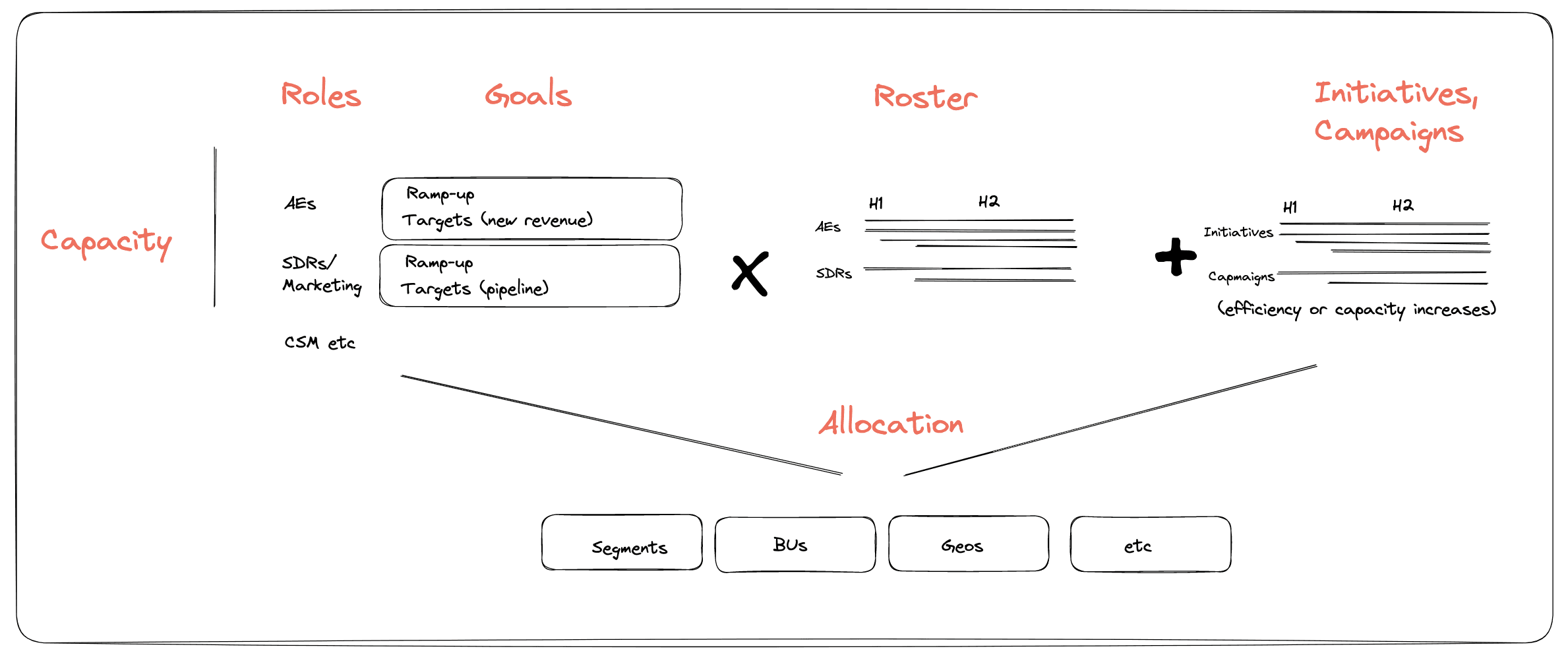

💡 A revenue plan allows the revenue leader of an organization to connect the goal (aka: revenue) with (1) the budgets, (2) people and (3) initiatives needed to achieve it.

Typically it is a mathematical model, which breaks down “revenue” into different steps, adds assumptions about lead times and conversion rates and e voila…you have a great scientific model to forecast the future 🔮

Done right, you can make statements like: “If I invest 1m$ into campaigns today, I can expect 10m$ of qualified pipeline in 6 weeks, which will give me 2m$ of revenue in another 8 weeks.”

Sounds easy, but why is it so hard to get it right?

If I were to summarize the biggest challenges, I would name three main areas:

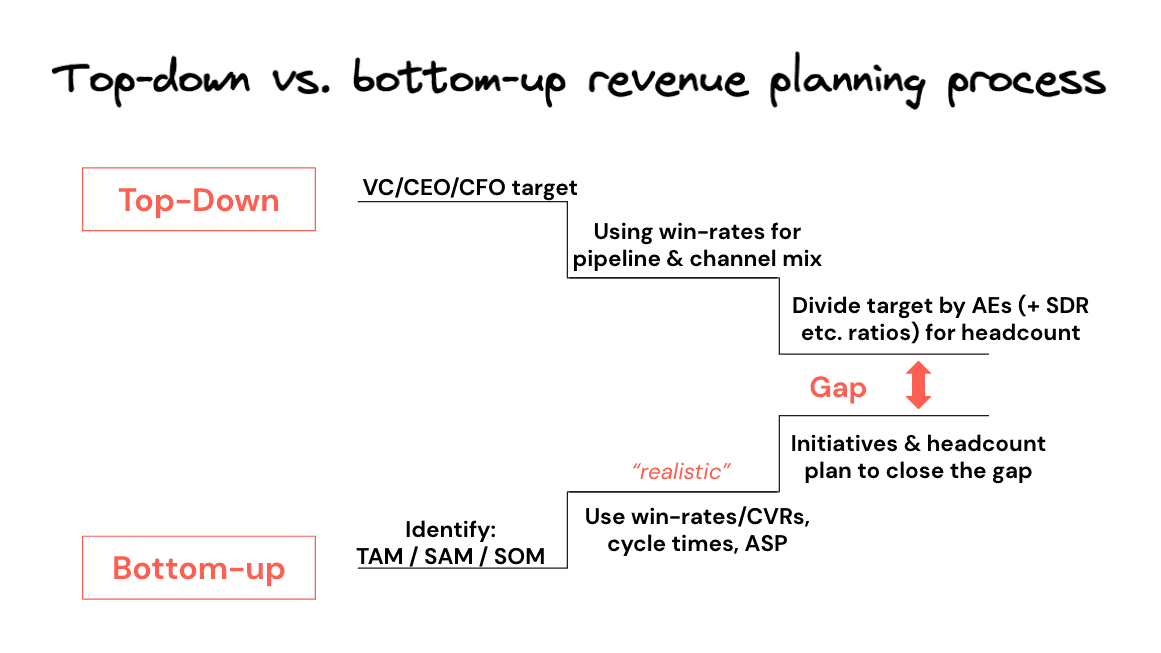

Top-Down needs a Bottom-Up Challenger: A clear direction by the board is the first step - but it does not translate into everybody’s day to day job.

It is actually not that simple: Many things can go wrong along the way, making this a purely “theoretical exercise”, which no employee will trust

A plan is good, routine makes it reality: No plan can predict the future - therefore it needs to be constantly adjusted to incorporate changed variables.

But let’s dive into each of these points a bit deeper.

1) Relationship between Finance and Revenue needs to be tight

Starting with clear top-down guidance by the board or the CEO is a good first step. “What does it take to reach $20m ARR until End of Year”? Many follow the “unicorn manifesto” of T2D3 (Triple, Triple, Double, Double, Double) 🦄

“Good” companies break their high level perspective further down - into markets, products, segments and channels. They understand that a) “inbound mid-market revenue” follows a totally different logic than “outbound Enterprise revenue” and b) to give individual people direction, you need to bring it down to their granularity.

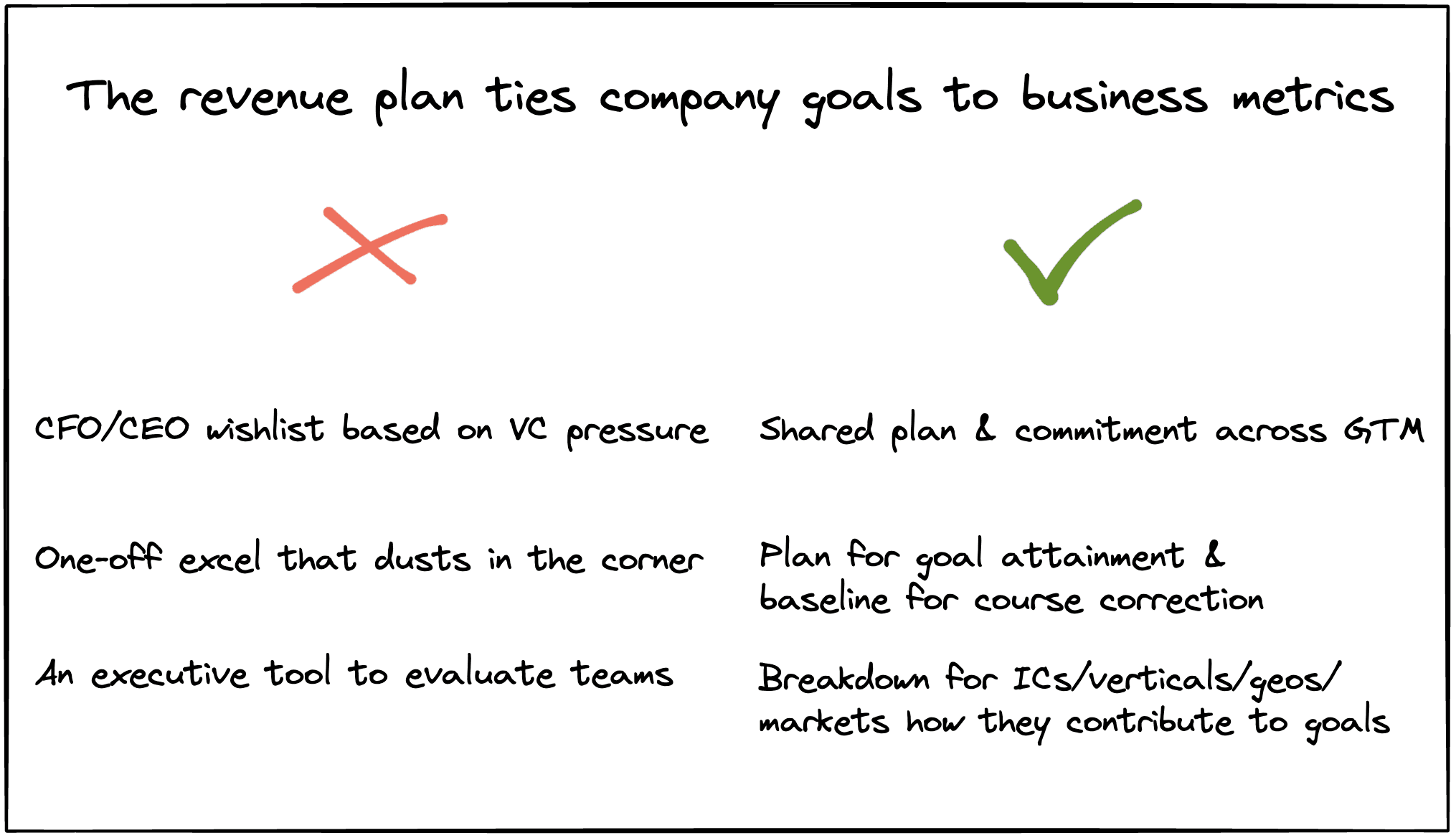

“Excellent” companies allow in the next step each GTM leader to challenge the underlying mathematical assumptions…. and enter based on that a “negotiation like” process. As a team this plan should facilitate a discussion where your upsides lie, how certain you are about each bet and move and what you need from each other to be successful.

Disagreements have to be dissolved at this point - afterwards it has to be “Divide and conquer”.

2) Excel does not create trust

During my time as CRO I have built and seen A LOT of Excel sheets…but a great spreadsheet alone does not get you anywhere. To convert it into success, you need:

Transparency: People consume insights in different ways. And there is a good reason why slide-decks and executive summaries are still the preferred style of communication….they tell a story. Excel lacks this ease of presentation.

Data Trust: Getting data to be accurate is hard…especially RevOps Folks know that. Once people questions the basics, the discussion gets quickly derailed.

Simplicity: The “Old” way of revenue planning with (Revenue = Quota per AE x # of AEs) has one big advantage…everybody gets it. “Newer” ways of revenue planning consider also 2nd and 3rd order consequences which are difficult to see at first sight (e.g. 2nd order - planning gaps in lead supply for those AEs; or 3rd order - knock-on effect of increasing SQL → SAO CVR on SAO → Won CVRs). Therefore they require a lot of initial explanation.

So if people a) can’t see it, b) don’t trust the data and c) don’t understand the logic, it will be hard to have full trust in any planning exercise.

3) Alignment is created through constant repetition

The process starts often with a one-off planning exercise…but then the hard work starts. Day-to-day grinding, surprises happen, people leave, a recession happens etc. etc. So essentially: The normal life of scaling a business.

You can’t plan for this to 100%, you can only instil a routine to stay nimble and adapt quickly.

For this you need:

To meet regularly across the team

Make it super-easy to have all relevant data in place to make updated decisions

Leave no deviation from plan without an action item

It sounds simple… but getting the basics right seems to be actually the hardest part.

Let’s summarize in between…

So far we have discussed that a revenue plan….

Is NOT: An Excel model to make your board and CEO happy

It IS: A shared understanding of the direction and ToDos as a team and individuals

If you were to give me a checklist, what are the most important things to master?

This is of course the golden question 😃

There is not this one golden bullet to solve it. But there is a series of steps you can take. I’ll list a few below (in unprioritized order…it always depends on the individual organizational context of where you are at)

Build out a strong RevOps function: There is a reason why RevOps is the largest growing job in the US…setting up a “true” RevOps team (i.e. that’s not limited to CRM wizardry) will be your best bet to translate fancy board slides into money on the bank account.

Make it granular: GTM motions follow different behaviors - a flat 30% win rate, while you double the share of revenue coming from outbound poses its own challenges. You need to break it down along markets, channels, segments and products.

Assign clear responsibilities: If three people are responsible…..nobody will feel responsible. Therefore assign clear accountability for core metrics to teams and individuals. At the core: Revenue, Pipeline, “Meeting ready leads”, Conversion rate and Lead Time.

Review it monthly: A one-off exercise or even a quarterly exercise is not enough. At today’s fast pace things change quickly. If you are enabled to have “MBR level” clarity on a weekly base, you know that you are able to run a tight ship.

Develop a love for definitions: It sounds simple… but if you ask five people across your organization how they define “revenue”, I am pretty sure that in 80% of the cases you won’t get the same answer. Downstream implications of that: You don’t speak the same language 🤯

So make it playful - ask people to draw processes on paper, make mini-quizzes, and most importantly: limit “creative metric inventions” just to show some form of traction. Keep it to a core set, which everybody understands.

When you do all of these things, I can’t promise you of course that you will hit your goal every month - but you will be at least a significant step closer, by focusing on the things, you can directly influence.

If you have questions regarding your revenue plan or want to learn how pyne can mitigate the complexity of revenue planning, reach out to us here.